出荷数から見たGPU市場 ~Jon Peddie Research リポートをもとに~

売る材料が全くない。

売りを勧めるアナリストもほぼ消滅した。

おそらくNVDAはQ4でも史上最高のレヴェニュー&EPSを叩き出すだろう。

ということは。。。

そろそろNVDAとお別れの時期が近づいているのか~

さみしいなぁ。

iGPU = integrated GPU

dGPU = discrete GPU

GC = graphic card

AIB = add in board

---------------------------------------------------------------------------------------------------------------

Mark Hibben(Seeking Alpha contributer)

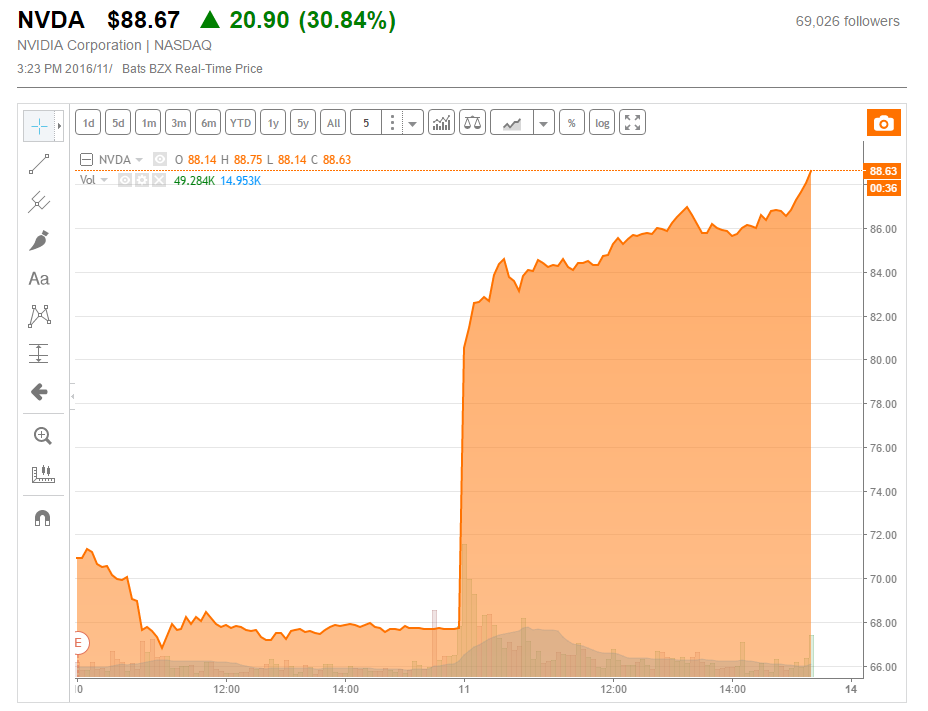

NVDA Gains GPU Market Share In Q3

Nov. 18, 2016 1:22 PM ET

・Summary Data from Jon Peddie Research shows that NVDA took GPU market share away from AMD in Q3.

・The research data focuses on PC applications for GPUs, and thus ignores NVDA GPU sales in the DC for high performance computing and AI, as well as automotive.

・I expect NVDA to gain even more share in PC GPUs in Q4.

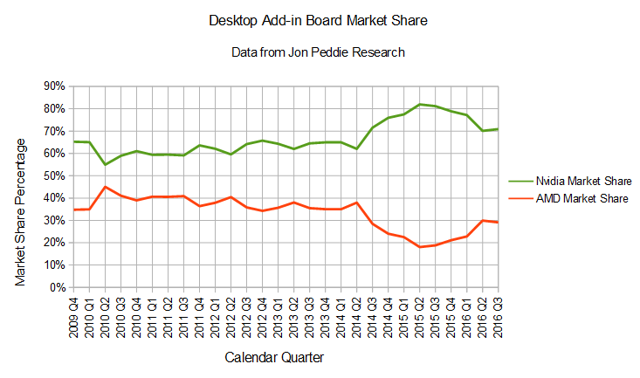

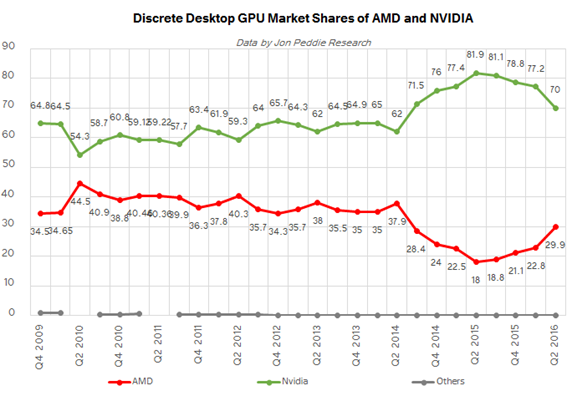

According to from JPR, NVDA gained market share in PC GPUs compared to last quarter. While the gain was not great, it was enough to halt AMD's GPU market share growth of H1.

・With the introduction of the entry level GTX 1050 and 1050 Ti, NVDA is poised to continue gaining share in Q4.

Source: Jon Peddie Research

〇 Undercounted GPUs

・JPR data for GPUs is focused exclusively on the PC market, ignores the use of GPUs in the DC.

・Thus JPR's results only include desktop dGPUs that are present in graphics cards (called by them AIB), and present in notebooks.

・Also counted are processors, such as AMD's APUs and many Intel processors for mobile applications that include on-board graphics processing. This increases the count of AMD's GPU shipments, relative to NVDA.

・But not counted are NVDA's shipments of GPUs for HPC and DL applications in the DC. Also not counted are NVDA's shipments of Tegra processors, which also include on-board GPUs.

・This will become an even more important segment for NVDA as it ships more Drive PX‐2 solutions for Tesla motor's new Autopilot system, since these include both high performance Pascal GPUs as well as the latest Parker generation Tegra that also feature Pascal architecture graphics.

・So the reader should take the JPR data with a grain of salt, since the data ignores important growth areas for NVDA.

〇 neither market share gain nor profitability was to be AMD's lot in Q3.

the Computing and Graphics segment of AMD still posted an operating loss of $66 million on revenue of $472 million (which includes processors, APUs for PS4 etc and GPUs).

・See the stark contrast between AMD's unprofitability in Q3 and the huge revenue and profit gains of NVDA in its fiscal Q3.

・NVDA's GPU revenue of $1.697 billion was alone larger than AMD's total revenue, and was up 53% y/y. NVDA posted a GAAP operating income of $708 million, up 130% y/y, while AMD posted a GAAP operating loss of $293 million.

・JPR's market share and unit shipment data for AIB show that AMD's market share gains were halted in their tracks in Q3. While unit shipments for both companies increased, NVDA's unit shipments increased faster.

Investor Takeaway

NVDA's superior GPUs have halted AMD's share gains in the desktop dGC segment, for the time being. Even worse, NVDA has deprived AMD of operating profit.

ーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーー

※ここでのQ1,Q2,1Hは、通常のカレンダーどおりで、NVDAの四半期決算期とはズレているので注意!

Aaron Stuart/Sep 21, 2016

Desktop dGPU Market Trends Q2 2016: AMD Grabs Market Share, But NVDA Remains on Top

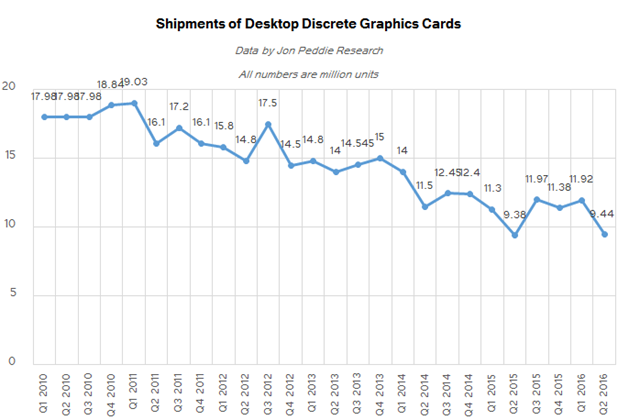

・Unit sales of desktop dGC are traditionally not strong in Q2. Shipments of GC nearly hit a multi-year low after dropping by around 20.8% from the previous quarter, according to JPR.

・During the quarter, AMD managed to slightly improve its shipments and gained market share, whereas NVDA’s unit sales of desktop dGPUs were down. Nonetheless, the latter still commands the lion’s share of the market.

The Market Is Changing

Before we look at the numbers for Q2 2016, we should take a short look back to understand what is happening on the market of dGPUs and why it is transforming nowadays the way it is transforming.

While iGPUs have been around for 15 years, it’s only in the last 5 years that they’ve been a first class citizen in the desktop market.

The catalyst for this change was when Intel integrated their GPU into their CPU itself in 2010 with Sandy Bridge.

By moving the GPU to a leading-edge process and by allocating ever-greater transistor budgets and die space to its various blocks, performance of their iGPUs started to increase rapidly.

Today, higher-end Intel’s iGPUs can successfully compete against entry-level dGPUs, severely curtailing the sub-$100 dGPU market and significantly shrinking TAM of standalone GC.

For example, in 2006, the industry sold approximately 84.65 million desktop dAIB. However, unit sales of such components in 2015 dropped to about 44 million units.

Even though iGPUs may eventually replace affordable GC, high-end dGPUs continue to gain horsepower every year and their level of performance is miles ahead of iGPUs.

Moreover, the population of gamers who need advanced dGC to play their favorite titles has grown.

As a result, while the TAM of standalone GPUs is shrinking, the demand for high-performance dGC is growing; the market is (broadly) shifting towards a more enthusiast-centric market.

In the recent years shipments of high-end desktop GPUs totaled around 2.8 – 3 million units per year (2.9 million in 2014), but in 2015 sales of such products increased to 5.9 million units.(ハイエンドグラボ市場は、2014年~2015年の1年でほぼ倍増している。)

It is impossible to tell when unit sales of desktop dGC hit the bottom and demand for high-end dGC peaks. There are still millions of low-end dGC sold every year and it does not look like they are going to disappear overnight.

But given the current trends, it is clear that developers of dGPUs tend to invest more in development of mainstream and high-end processors and less in creation of entry-level chips.

〇 Overview of Q2 2016 (unit shipments)

In the Q2 of 2016, the industry sold between 62.4 million and 64.3 million PCs, according to IDC and Gartner respectively.

Meanwhile, dGPUs were used in 27.78% of PCs, claims JPR. Since the latter does not disclose its overall PC numbers, we can only estimate that shipments of dGPUs (for desktops and notebooks) were between 17.33 and 17.86 million units, based on the numbers from IDC and Gartner.

JPR estimates that shipments of standalone GPUs in Q2 2016 were down 14.19% from the previous quarter, and decreased 1.03% from Q2 2015.

While unit sales of PCs in general were down YoY – between 4.5% and 5.2%– their shipments did not decrease QoQ.

According to Gartner, they remained on the same level and according to IDC they actually increased by nearly two million units. Moreover, JPR claims that unit sales of desktop PCs were up 2.5% QoQ.

But despite relatively strong demand for desktops PCs, shipments of dGC for such PCs declined by 20.8% QoQ, but increased by 0.8% YoY.

Desktop Discrete GC Market in Q2 2016 (Data by JPR)

Q2 2016 Q1 2016 Q2 2015

Share Shipments Share Shipments Share Shipments

AMD 29.9% 2.82 22.8% 2.7 18% 1.68

NVDA 70% 6.6 77.2% 9.2 81.9% 7.68

Numbers are in percentage points or in millions. Numbers are approximate.

We can estimate that various makers of AIBs sold approximately 9.44 million dGC in Q2 2016, which is slightly up from 9.38 million units in Q2 2015 (see notes below).

As pointed out above, the Q2 is seasonally not good for unit sales of desktop dGPUs.

However, it looks like 2016 seems to be shaping up well for AIBs in general: unit sales of desktop GC in Q1 were 11.92 million (up from 11.3 million in the same period a year ago) and in Q2 they totaled 9.44 million units.

Shipments of desktop dGPUs in 1H 2016 increased by approximately 3% YoY to 21.36 million units (which means that AIB suppliers sold at least 650K more dGC than in 1H 2015).

〇 Market Shares: AMD Is Regaining Ground Amid Flat Shipments

Historically, AMD commanded 35 – 40% of the desktop dGPU market. Things started to turn south for AMD in Q3 2014 both in terms of shipments and share.(これはGTX980 GTX970の発売時期だよね)

By Q2 2015, the company’s share dropped to 18% and unit sales of desktop dGPUs declined to 1.69 million units.

By contrast, NVDA was thriving: its market share increased to as high as 82% in Q2 2015, but since the PC market was shrinking, its unit shipments did not grow very significantly.

To regain market presence, AMD had to clear-out old inventory and address niche markets with products like the Radeon R9 Nano.

The measures along with low base effect helped the company to demonstrate steady growth of desktop dGPU shipments over the past 12 months.

Seasonality did not affect AMD in Q2 2016 and the company managed to increase its shipments by ~100 thousand of units (if our estimates are correct).

〇 2016のQ2(4-6)でNVDAが出荷数を減らした

Unlike its rival AMD, NVDA was affected by seasonality in the Q2, and likely anticipation of its Q2/Q3 product launches. Moreover, the company decided to clear out some of the inventory of older model GCs amid the launch of Pascal-based GeForce 1070 and 1080 GC, according to JPR.

This greatly affected actual shipments and market share of NVDA: unit sales decreased by 14% YoY and by 28% QoQ, whereas market share declined to 70%.

〇 AMD: Mining and Polaris Help to Drive Growth

AMD sold approximately 5.5 million of desktop dGPUs in H1 of 2016, up from 4.2 million in H1 a year ago.

The company’s management says that the recent introduction of its Polaris-based Radeon RX 470 and 480 GPUs helped it to increase unit sales in Q2.

“Our strong second quarter graphics performance was capped by the launch of our new Polaris-based RX 480 GPUs at the end of June, which helped contribute to our highest desktop channel GPU shipments since the fourth quarter of 2014,” said Lisa Su, CEO of AMD, during the conference call.

“We also delivered our third straight quarter of sequential professional graphics revenue growth and believe we gained share driven by increased adoption of FirePro graphics by OEMs as well as several cloud DC GPU compute wins.”

Strong mainstream offerings like Radeon RX 470/480 GC could help AMD to further increase shipments of desktop AIBs in the coming months. The company admits that to further boost unit sales, it needs more chips from Global Foundries, but it assures that their yields are improving.

“Since then, the demand has continued to be strong and so some of the retailers are out of supply. We do see that the 14 nm LPP yields are good and we are ramping up production steeply.”

A good news for AMD is that unit sales of desktop dGC in H2 are traditionally higher than in H1. Therefore, if everything goes well and the company manages to capitalize on its Polaris architecture, it has chances to sell more desktop dGPUs in 2016 than it did in 2015.

〇 NVDA: Thanks to Pascal, Gaming GPU Revenue Nearly Sets All-Time Record

From a volume perspective, sales of NVDA’s desktop dGPUs decreased in H1 of 2016 in general (to ~15.81 million units, down 4% YoY) and in Q2 in particular (to ~6.61 million units, down 14% YoY and 22.2% QoQ). A big drop of unit shipments caused a decline of the company’s market share.

However, lower unit sales do not always translate into poor financial results. If we take a look at NVDA’s financial results for Q2 FY2017 (started on May 2, ended on July 31, so it is not exactly calendar Q2), we will notice a 18% YoY and a 13% QoQ increase in the company’s gaming GPU revenue.

While it is not exactly right to compare calendar Q2 with NVDA’s Q2 FY2017, even such comparison gives us an idea what happened in April – July period.

Since demand for dGC by mainstream users in Q2 is not strong, the company decided to clear out its older inventory and not pursue volume shipments, but focus on ramping up new Pascal-based products.

This clearly cost the company a lot from the market share point of view, but to a certain degree, it stimulated demand for higher-end Pascal GC by gamers. Since the new GeForce GTX cards command a significant price premium, NVDA naturally improved its earnings during the quarter.

Demand for NVDA’s latest GC was very high and many observers reported shortages of the new AIBs. The company claims that yields of its GPUs produced using TSMC’s second-gen 16nm FinFET process technology (CLN16FF+) are going to improve, which will clearly amplify its supply.

Even though Q2 2016 was not very good for NVDA from unit sales point of view, H2 is going to be better in general. The company will try to capitalize on its comprehensive lineup of mainstream and high-end GPU offerings based on its Pascal architecture.

In fact, due to the launch of two GeForce GTX 1060 SKUs in Q3, unit sales of Pascal-based products will inevitably be higher this quarter compared to Q2. However, it remains to be seen whether the company manages to sustain its annual GPU unit sales at ~35 million this year.

〇 Wrap Up

Despite relatively weak shipments of PCs in 2016, unit sales of desktop dGC in the first half of this year are actually higher that unit sales of such products in the same period a year ago.

Declines of AMD Radeon sales seem to be over, but the company still has to do a lot to re-capture lost share from NVDA. In Q2 AMD managed to sell approximately 2.8 million of desktop AIBs and commanded 29.9% of the market.

With 6.6 million desktop dGPUs sold in Q2(4-6) and 70% share, NVDA remains the leader in this segment of the market despite significant drop of its unit shipments.

iGPU is slowly shrinking TAM of dGPUs and going forward, unit sales of entry-level graphics processors will continue to drop.

By contrast, sales of high-end desktop AIBs are on the rise, and last year has seen both AMD and NVDA benefit from that. Enthusiasts are still a small part of the big picture, but as GPU prices and sales patterns continue to drift towards the high end, they are an increasingly critical part of the picture.

Important Notices

JPR does not officially disclose actual unit sales of AMD, NVDA and Intel in its press releases. All unit sales published here are derived from market shares of appropriate vendors.

Since in many cases JPR does not disclose quarterly TAM numbers, those numbers are derived from historical numbers published by the company.

--------------------------------------------------------------------------------------------------------

JPRの元の記事(抜粋)

NVDA increased everything in Q3 2016. Total GPU shipments up a whopping 20.4%, from last quarter

NVDA’s market share increased 2.2% from last quarter and 0.4% from last year, Intel lost 1.6% market share from last quarter, and AMD’s overall share decreased 0.6%, from last quarter

This is the latest report from JPR on the GPUs used in PCs. It is reporting on Q3'16 results.

The PC market rose in Q3 from Q2, but declined from the same quarter last year. The QoQ gain was largely due to gaming as well as DC sales.

PC suppliers are seeing growth in gaming desktops and notebooks, and hope this will offset the slowdown in overall PC shipments.

While they are high ASP systems, the two segments combined can only contribute a few million unit shipments a year, less than the decline of the total PC market.

Overall GPU shipments (rounded up) increased 20% from Q2, AMD increased 15% NVDA increased 39% and Intel, increased 18%. YoY overalll GPU shipments increased 0.3%, desktop graphics decreased -4%, notebooks increased 3%.

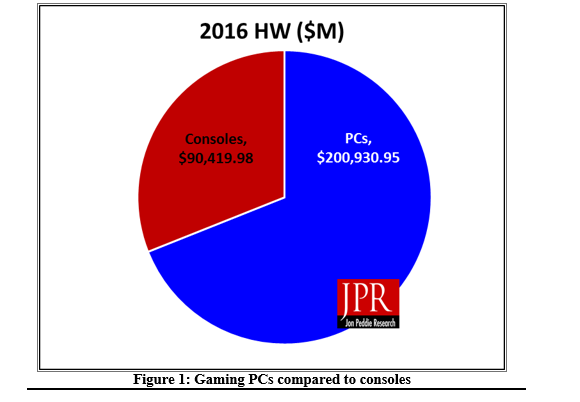

If anyone doubted that the PC was the platform of choice for gaming, this quarter’s results will correct that misconception. The gaming market is lifting the entire PC market and has overwhelmed the console market.

(世界規模ではコンソールゲーミングはPCゲーミングと比べてもはやマイナーな存在になってる)

NVDA did particularly well in Q3’16, fueled by their Pascal-based product line and the rash of new AAA graphics-demanding titles.

Q3(7-9) is typically the strongest from Q2 in the seasonal cycles of the past. For Q3'16 we saw an increase of 20.4% from Q2, and the gain was above the ten-year average of 9.52%.(NVDAのQ3は8-10)

The three market leaders, AMD, Intel, and NVDA all introduced new products in H1 while the channel and OEMs sold off older inventory. Q3 saw the channel and OEMs restocking for the holiday season, and doing so with enthusiasm indicating a bullish attitude.

〇 Quick highlights

- AMD’s overall unit shipments increased 15.38% quarter-to-quarter, Intel’s total shipments increased 17.70% from last quarter, and NVDA’s increased 39.31%.

- The attach rate of GPUs (includes integrated and dGPUs) to PCs for the quarter was 146% which was up 14.96% from last quarter.

- dGPUs were in 34.84% of PCs, which is up 7.06%.

- The overall PC market increased 8.09% quarter-to-quarter, and decreased -5.37% year-to-year.

- Desktop graphics AIBs that use dGPUs increased 38.16% from last quarter.

- Q3'16 saw a decrease in tablet shipments from last quarter and saw notebook sales out sell tablets for the first time in three years.

Q3 is, on average, usually up from Q2 as the channel and OEMs stock up for the holiday season. Judging by the big overall increase, those resellers are anticipating a strong demand in the 4th quarter.

GPUs are traditionally a leading indicator of the market, since a GPU goes into every system before it is shipped, and most of the PC vendors are guiding cautiously for Q4’16.

One thing to note, the Gaming PC segment, where higher-end GPUs are used, continues to deliver growth for PC makers. New gaming content and the promise of VR help drive the demand for gaming desktops and notebooks.

This research finds that global GPU market demand in Q3'16 increased from last quarter, and increased from last year, to 100.30 million units.

In recent years, as the gaming ecosystem is shaping up, software and hardware developers, information service providers, and even governments have been attempting to unearth market opportunities coming from this new arena. However, global PC shipment volume is forecast to fall further.

〇 The quarter in general

AMD’s shipments of desktop heterogeneous GPU/CPUs (APU) for desktops decreased -10% from the previous quarter.

AMD's shipments were up 19.1% in notebooks. Desktop dGPUs increased 34.7% from last quarter, and notebook discrete shipments increased 23.0%. AMD’s total PC graphics shipments increased 15.4% from the previous quarter.

Intel’s desktop processor embedded graphics (EPGs) shipments increased from last quarter by 4.1% and notebook processors increased by 18.8%, and total PC graphics shipments increased 17.7% from last quarter.

NVDA’s desktop dGPU shipments were up 39.8% from last quarter; and the company’s notebook dGPU shipments increased 38.7%, and total PC graphics shipments increased 39.3% from last quarter. NVDA attributes the growth to the strong acceptance and demand for its new Pascal line of graphics chips and boards. The company’s share price is at an all-time high.

Total dGPUs (desktop and notebook) shipments for the industry increased 35.6% from Q2, and increased 10.1% from last year.

〇 おまけ (グラフィックチップ市場全体のユニット数における3社シェア、当然ながらインテルが圧倒的)

99% of Intel’s non-server processors have graphics, and over 66% of AMD’s non-server processors contain integrated graphics; AMD still ships integrated graphics chipsets (IGPs).

It can take the form of a discrete chip, a GPU integrated in the chipset or embedded in the CPU. The average has grown from 1.2 GPUs per PC in 2001 to 1.46 GPUs per PC.

ーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーー

PC Add-in board market increased in Q3'16, AMD lost market share, while NVDA gained

Quarter-to-quarter AIBs shipments increased 38.2%, and 9.2% year-to-year.

JPR announced estimated PC graphics add-in-board (PC AIB) shipments and suppliers’ market share for Q3'16(7-9).

AIBs using dGPUs are found in desktop PCs, workstations, servers, and other devices such as scientific instruments. They are sold directly to customers as aftermarket products, or are factory installed by OEMs.

In all cases, AIBs represent the higher end of the graphics industry with their discrete chips and private, often large, high-speed memory, as compared to the iGPUs in CPUs that share slower system memory.

The primary suppliers of GPUs are AMD and NVDA. There are 48 PC AIB suppliers, the PC AIB OEM customers of the GPU suppliers, which they call “partners.”

We have been tracking PC AIB shipments quarterly since 1987—the volume of those boards peaked in 1999, reaching 114 million units, in 2015, only 44 million shipped.

The news for the quarter was encouraging and seasonally understandable, QoQ, the PC AIB market increased 38.2%, which is above the ten-year average of 14.3%. (compared to the desktop PC market, which decreased -7.1%).

On YoY basis, we found that total AIB shipments during the quarter rose 9.2%, which is greater than desktop PCs, which fell -17.1%.

〇 Gaming the game changer.

However, in spite of the overall PC churn, somewhat due to tablets and embedded graphics, the PC gaming momentum continues to build and is the bright spot in the AIB market.

The gaming PC (system) market is as vibrant as the dAIB market. All OEMs are investing in Gaming space because demand for Gaming PCs is robust.

しかしながら、ゲーミング向け出荷数は、市場全体の出荷数の中の数字には、表れにくい(it won’t show in the overall market numbers), because like gaming GPUs, the gaming PCs are dwarfed by the general-purpose machines.

The overall GPU shipments (integrated and discrete) is greater than desktop PC shipments due double-attach—the adding of a second (or third) AIB to a system with integrated processor graphics.

The attach rate of AIBs to desktop PCs has declined from a high of 63% in Q1 2008 to 54% this quarter, an increase of 48.7% from last quarter which was outstanding. Compared to this quarter last year it increased 31.7% which was outstanding.

NVDA Q3 2016 カンファレンスコールQ&A

EPS of $0.94 beats by $0.30 | Revenue of $2B (+ 53.8% Y/Y) beats by $310M

Q&A セッション

―――――――――――――――――――――――――――――――――――――――

Q1:Mark Lipacis - Jefferies LLC

DC部門が前年比3倍になったわけだが、なぜこのようなことが可能だったのか?それはテクノロジーサイドの出来事なのか、マーケットサイドの出来事なのか?そしてDC部門の売上成長のドライバーを教えてほしい。

A:Jen-Hsun Huang - NVIDIA Corp.

GPUコンピューティングが必要とされる領域はますます増えている。そして、企業のいたるところに浸透しつつある。我々のDC事業の成長を支えるいくつかの要因だが、

1番目が、GRIDすなわち、VMware やCitrix などと取り組んでいるグラフィック仮想化、アプリケーション仮想化だ。計算負荷の高いアプリケーション、グラフィック負荷の高いアプリケーションを仮想化してDC内に配置するという取り組みだ。

2番目が科学技術計算だ。GPGPUという、汎用目的でGPUの計算能力を利用するものだ。今や科学技術計算は、研究者だけのものではなく、多くの産業で重要になってきている。

3番目がDLだ。AIイノヴェーションを世界中に巻き起こしてきた。

これらがDCビジネス好調の要因だ。

このような前年比売上高3倍増という結果は、グラフィックチップ企業から、汎用チップ企業への転換、もっと言えば「チップ企業からプラットフォーム企業への転換」によってもたらされた。

例えばグラフィック仮想化を可能にしているのはGRIDというソフトウェアの集積の上に成り立つ仮想化サービスだ(このソフトウェアの集積+GPUの有機的結合こそがプラットフォームたるゆえん。)。

また、数値計算や計算科学では、CUDAやその上で展開される数値計算ライブラリー群がある。我々はこれらの開発に注力してきた。

これらのハードとソフトが融合したエコシステムによって、今や世界中の開発者がCUDAを利用して独自のアプリケーションを開発することができる。このことが一番の成長要因だ。

また、NVDAのDLツールキットもある。これにより(Caffe、Chainerなどの)あらゆるDLフレームワークが、GPUアクセラレーションの恩恵を受けることができる。

GPUアクセラレーションは、20%の改善ではなく、20倍の改善をもたらすものだ。これは大幅な時間節約をもたらすものではあるが、それに伴いDCコストやエネルギー消費の大幅な削減ももたらすことができる。

GPUが搭載されたラックサーバーが複数あれば、バスケットボールコート程のoff-the-shelf servers を置き換えることができるのだ。これは企業にとっても大幅な経営資源の節約につながる。

―――――――――――――――――――――――――――――――――――――――

Q2:Vivek Arya - Bank of America Merrill Lynch

DCビジネスなのだが、2年前は50%以上成長したものの、去年は7%成長だった。今期は196%成長している。なぜこのような振れ幅があるのだろうか。この変動をもたらすと思われる、顧客の変化や、アプリケーションの変化をどのようにとらえるべきか。

A:Jen-Hsun Huang - NVIDIA Corp.

GPUコンピューティングをDCに導入しようとしたときに、まずスパコン分野から手掛け始めた。それからリモート・ワークステーション(DCワークステーション、ワークステーション仮想化)を手掛けた。

そして、現在ハイパースケールDCからの需要が増加している。そこではGPUが、DLとそのためのニューラルネットワーク開発(トレーニング)に利用されている。また多くのDCが、DLにおける推論用に、P40 and P4を大規模に利用し始めている。

また今後DC事業は複数の展開を見込んでいる。

- 実行可能なアプリケーションの数をさらに増やしていくこと。今や一つのアーケティクチャの上で、グラフィック仮想化から数値計算、AIまでのアプリケーションを実行できる。

- GRIDのみならず、それに加えてスーパーコンピューティング分野、ハイパースケールDC分野(AWS、AZURE)でも事業を展開していること。

- 対象産業としては、以前はもっぱらスーパーコンピューティング産業が中心であったが、現在では自動車産業、ガス&オイル、エネルギー探査企業、金融サービス、消費者向けインターネットクラウドサービス(consumer Internet cloud services.)など幅広い顧客を獲得している。

これらの3つの側面の組み合わせすべてが、DC部門の成長の可能性を示していると感じている。

もう一度言うと、アプリケーションのさらなる増加、我々が構築してきたプラットフォーム、そしてますます多くの産業領域で利用されつつあること。これらの組み合わせにより、コンスタントな成長を見込める。

(the combination of that should give us more upward directory in a consistent way.)

(グラボ産業、PC産業以外の)あらゆる産業にこのようなマグニチュードで関与することができるのは、会社ができから、初めてのことだ。

ーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーー

Q3:Toshiya Hari - Goldman Sachs & Co.

この数か月間GTCなどで世界中を回り、主要顧客やパートナーと会ったと思うが、そこで得た感触、今後の企業の方向性などを教えてほしい。

A:Jen-Hsun Huang - NVIDIA Corp.

今回世界中を旅した一番の理由は、世界中のディベロッパーからGPUコンピューティングをより深く理解したい、我々のプラットフォームを利用したい、GPUで加速できる多くのアプリケーションについて学びたいという強いリクエストがあったからだ。

需要があまりに強かったので、もはや本格的なGTCをシリコンバレーだけで開催していくべきではないと考え、世界中に本格展開した。

その中で2つのテーマが浮かび上がってきた。

今や世界中のPC、クラウド、DC、ラップトップでGPUを使うことができる。GPUはもはやニッチな部品ではない。これは大規模に利用可能な、汎用目的のコンピューティング・プラットフォームなのだ。

驚異的な時間短縮、コストダウンが可能だというGPUの利便性にみんなが気がついている。時間短縮とコストダウンはコインの裏表でセットになっている。

- AIをとりまく熱狂だ。

物理法則ベース、方程式ベースの数値的アプローチで解決することのできない数多くのアプリケーション、問題、課題がある。これらの問題は、しばしば複雑で不完全な問題設定がなされており、物理法則が及ばないたぐいの問題だ。

どうすれば他人から見栄えよく見えるか?についての法則、今夜みるべきオススメの映画の法則などなど

これらの不完全な問題をどのように解決すべきなのだろう。それに従ってプログラムを組むことができるような自然法則は存在しない。自動車を「適切に」自動運転させるという問題もそうだ。これらはすべてAI問題なのだ。検索、オススメ機能などもAI問題だ。

世界中で盛り上がっているのが、これらのAI問題を、GPUによるDLでどのように解決してくのか、ということだ。

大規模なデータの中から、そのデータセットの特徴量をコンピュータ自身が見つけ出し、決定していくこと。認識すべき特徴をコンピュータ自身がコンピュ―トしていくこと。これらがGPUを利用したDLにより可能となってきている。GPUによるDLがこのAI革命の波を引き起こしたのだ。

これはヘルスケア、運輸、エンターテイメントなどあらゆる企業に共通する現象なのだ。

――――――――――――――――――――――――――――――――――――――

Q4:Atif Malik - Citigroup Global Markets, Inc. (Broker)

Q2のカンファレンスコールで、グラボのマクスウェル世代へのアップグレードした人が、全体の3割だとのことだったが、2年のアップグレードサイクルとかそこらへんのところを教えてほしい。(回線不調で聞き取れず)

A:Jen-Hsun Huang - NVIDIA Corp.

回線の調子が良くないみたいだ。あなたの質問内容を推測して答えるが、そして、これこそがまさにAI問題なのだが。。。あなたの質問は、パスカル世代のアップグレードサイクルと、その進行具合についてであろう。

過去において、グラボのアップグレードサイクルは2年~3年であった。そして今までも6,000万人~8,000万人のユーザーがインストールベースでいた。

まずパスカル世代のグラボの導入は増えている。ユニット数も増加している。ASPも同時に上昇している。

その背景として重要なことがいくつかある。

- まずゲーマーの数が全世界で増加していること。

過去10年~15年に生まれた世代は、全員がゲーマーだといってもよい。

彼らが、電化製品やインターネットに慣れ親しんでいるのと同じく、彼らはゲーマーという側面も持つ。

- ゲームの品質が格段に向上していること。

この品質の向上・生産額の拡大(production value)は、XboxとPS4が爆発的に普及してきたことでもたらされたともいえる。

これらのコンソールの形式は似通っている。最新のGPUを搭載し、プログラマブル・シェーディングを利用し、共通の特徴を有している。

デザインポントや、処理能力では異なっていたとしても、アーケティクチャ的には共通の特徴を持つている。

そして、最近 PlayStation と Xbox が4K ヴァージョンを、発売・発表した。

これはゲーム産業にとっても、NVDAにとってもエキサイティングなことだ。なぜならばゲーム産業の生産額(production value)がさらに拡大することにつながるからだ。これによって、最終的には消費者がハイエンドGPUを導入にしていくことになるだろう。

まとめると①ゲーマーの数が増え続けていること、②ゲームクオリティの向上とアーケティクチャ―の共通化により、ゲーム産業のproduction valueがコンスタントに増加していること。これらの2点が重要な点だ。

- そしてゲームはもはやスポーツだということ。

ゲームでありながら、ソーシャルな役割も果たし、スポーツ性も兼ね備えているということだ。

友人とハングアウトしたいがためにゲームをする人も多くいる。そしてたとえばLeague of Legends、StarCraftなどのゲームの複雑さ、ゲームのクオリティ、そのリアルタイム・シミュレーション性、リアルタイムでの戦略性、手と目の動きの連動、チームワークの必要性、これはまさにスポーツと呼ぶにふさわしい。これは楽しいと同時に、マスターするのが難しいものである。これらゆえに大きなスポーツイベントになりつつある。

将来は、Eスポーツは、巨大なスポーツビジネスとして成立していくだろう。すでにゲーム産業の規模が巨大なのだから。これは時間の問題だ。

これらすべてが、我々の市場規模の拡大、われわれのASPの拡大に貢献している。

(背景を語っているだけなんだがこれは、グラボの売れ行きに関してはQ4も心配しなさんなっていうメッセージなんだと思われ。。。)

――――――――――――――――――――――――――――――――――――――

Q5:Stephen Chin - UBS Securities LLC

GRIDについてだが、製造業や自動車産業からの引き合いが強いとのことであったが、野球に例えると、試合の何回の裏か表か、どんな具合だろうか。

つまりフル操業状態に向けて、立ち上げ局面(ramp)を登っているのかどうかということだ。とりわけ一般の事業会社向けサービスの動向や、market vertical についても聞きたい。

またゲーミングに関してだが、パスカル世代のグラボの供給立ち上げ具合(ramp-up)と、それらの需要サイドのギャップについても教えてほしい。

A:Jen-Hsun Huang - NVIDIA Corp.

GRID に関しては一回表の第一打席といったところだ。

なぜならば、将来アプリケーションは、クラウド上で、つまりDCの中において仮想化されると確信しているからだ。

原則として、アプリケーションは仮想化され、それをPC、クロームノートブック、リナックスワークステーション、マックで好きに利用するようになるだろう。

同時に、将来アプリケーションはGPUによって、ますます仮想化されていくことだろう。

GPUが導入されてないクラウドで、ますますGPUアクセラレーションを必要とするアプリケーションが増加する中で、どのように対処すべきか。

答えは、さらに多くのGPUをクラウド上やDCに導入していくだ。

これがGRID が手掛けていることであり、仮想化の意味するところだ。大規模DCにGPUを導入し、仮想化することだ。それによりどのようなコンピュータ、デバイス上で恩恵を受けることができる。これはデータにより近い場所でコンピューティングを実施してくということでもある。だから我々はほんの始まりにいるに過ぎない。

GRIDは長い年月をかけてようやくテイクオフした。エコシステムの構築、インフラの整備、ソフトウェア開発、優良なサービス品質の確保、エコシステムパートナー企業との協業の結果だ。

したがって(GRIDは)現在のペースでの成長をしばらく持続できると確信している

I could surely expect to see it continue to grow at the rate that we're seeing for some time.

またパスカル世代のグラボに関しては、現在も立ち上げの途中だ(ramping)

すべての製品が品質を確保しつつ、市場に供給されている。これらの製品は、OEMパートナーたちにより、品質を高められ、製品としての確実性を増している。その意味で、パスカル世代は立ち上がってきている(品質タラップの上のほうに駆け上がってきている)。

しかしながら、需要は強い(このお言葉を待ってました!ヒントありがとうジェンスン)。TSMCは素晴らしいし、イールド改善もファンタスティックだ。この改善のペースを続けていきたい。

―――――――――――――――――――――――――――――――――――――――

Q6 : Joseph Moore - Morgan Stanley & Co. LLC

DLのトレーニング用(P100)ではなく、推論用(推理用、推定用、結論用)(P4,P40)のマーケットに関して。どのくらいの市場チャンスがあると考えているか?

また推理用GPUは、そのマーケットに浸透し始めているところだろうと思う。そのこと対抗技術のFPGAの将来動向などの関連を教えてほしい。

A:Jen-Hsun Huang - NVIDIA Corp.

FPGA は、それ一つで何でもできるという点で非常に優れている。しかし市場規模が大きいならば、ASICを開発したほうが有利だ。FPGAは、生産量が多くないときに使うべきものだ。FPGA は、まだ開発製品の仕様や機能が確定していないときに使うべきものだ。

仕様がはっきりしているときは、ASICすなわちフルカスタムチップを作ることができる。それにより性能を高められる。20%の改善ではなく、10倍の改善をもたらすことができる。またエネルギー効率もFPGAを使うよりも高めることができる。これは技術者には周知の事実だったかもしれない。

NVDAのストラテジーは、(GPU vs FPGAといった対立とは)全く異なるものだ。我々は、コンピューティング・プラットフォームを作り上げることに注力している。我々のGPUは(CUDAを中心としたプラットフォームに接続されることにより)特定の機能に限定されるものでは、もはやないのだ。

NVDAのGPUは、汎用目的の並列プロセッサともいえる。CUDAは、分子動態シミュレーションにも使えるし、流体シミュレーションにも使える。偏微分方程式にも使えるし、線形代数にも使える。AIも動かせるし、耐震解析にも使える。使おうと思えばCGにも使えるのだ(冗談ぽく)。このようにフレキシブルなのだ。

このプラットフォームは、並列スループットコンピュ―ティング向けに設計されたものであり、CPUと組み合わせることによってシーケンシャルな情報処理、シーケンシャルなインストラクション処理を効率的にこなしつつ、大量のスループットデーターを処理することができるのだ。

数多くの産業(large industry)で有効利用されること。これがこのプラットフォームの構築が必要だった理由だ。

AIにも使えるし、検索にも使える、動画のトランスコーディングにも使えるし、エネルギー探索にも使える。医療、ファイナンス、ロボティクスにも使えるのだ。

だから最初に、プラットフォーム構築を優先察せてきた。これはコンピュ―ティング・アーケティクチャであり、専用アプリケーション的な何かではないのだ。私たちが取引している顧客、対応しようとしてる市場、注目している事業領域というのは、すべてのコンピューターユーザーたちなのだ。

みんなが、このプラットフォームを使いこなせるようにする必要があるし、かれらが独自のAIネットワークを急速に改善することにより恩恵をうることができる。

AIはまだまだ発展途上段階だ。GPUによるDLも急速なイノヴェーションを経験している。

GPUをコンピューティング・プラットフォームとして考えてみよう。そうすれば市場規模で、500万~1000万の大規模DCノードがその対象になる。

I think that tree is a new set of HPC clusters that have been added into these datacenters.

そして、次に起こるのはGPUがそれらの500万~1,000万のノードに導入されていくだろうということだ。

それにより、クエリー一つ一つを加速できるし、そのクエリーは将来AIクエリーになっていくだろう。

だから、GPUは、ハイパースケールDCにおいて、多くのインストールベースを獲得するような機会に恵まれている。

そして、さらにその先に事業会社向けのDC市場がある。

多くのコンピュ―ティングがクラウド上で行われるが、ここで述べているような類のコンピューティングは、大量のデータを必要とする。(それをすべてクラウド上で処理するのは難しい?)

また今後、事業会社向けのDC事業はますます、AI中心にシフトしていくだろう。

例えば、

・AIを使ってビジネスプロセスを簡素化する。

・AIを使ってビジネス上のヒントや知見を発見する。

・AIを使って、サプライチェーンを最適化する

・AIを使って売上予測を最適化する

・AIを使って、ネット上の潜在顧客を見つけ、驚きを与え、喜ばせること

これらは、すべてが大企業のビジネスオペレーションの一部なのであり、AIによって活性化されうるものだ。

そして、さらには事業会社におけるハイパースケールコンピューティング問題もある。これはIoT問題とも呼ばれる。

IoT では兆個単位のコンピュータがインターネットに接続される。そして、振動、音、映像、温度、空気圧などなどが測定されていく。これは世界中で起こることであろうし、それらを常に測定し、モニタリングする必要がある。

そこから付加価値を見つけ出すことができるのはAIだけだろう。

DLを使うことにより、これらの新しいタイプのコンピュータ(が生み出すデータ)を有効活用することができる。

だから、私たちが対峙している市場規模は、当社が経験したことがないような大規模なものなのだ。(marketplace that we're addressing is really larger than any time in our history.)

つまり、もっと単純に考えれば、我々はプラットフォーム企業だということだ。プラットフォーム企業で、GPUコンピューティングに焦点を絞っており、その際の主要なアプリケーションがAIだということだ。

―――――――――――――――――――――――――――――――――――――――

Q7:Craig A. Ellis - B. Riley & Co. LLC

自動車部門だが、インフォテイメントと自動運転コンサルティングと自動運転プロダクトがあり、現時点ではコンサルティングの比重が高いと思う。

しかし、将来的にはエグゼビアも控えており、今後売上ミックスはどのように変化していくのだろうか。コンサルティングからプロダクトというだけではなく、パーカーからエグゼビアということも含めて教えてほしい。

A:Jen-Hsun Huang - NVIDIA Corp.

我々も今後の市場動向、技術開発の動向に関しては確信を持っているわけではない。

しかし、自動運転技術のダイナミクスは、自動車業界にとって、破壊的テクノロジーとなるだろう。もはや5年後に何らかの形で自動運転車が走行していないと考えるのは難しい。

Tesla が直近で発表した自動運転車は、自動車業界にショックウェーブを与えた。AIを使った、完全自動運転の能力を備えていたからだ。これは本来ならば5年後に実用化されるはずだった技術だ。

これにより、2020年、2021年の実用化をメドとしていた自動運転技術のタイムスケジュールを、誰もが見直さなければならなくなっている。またこれにより、我々の自動車部門のビジネスプロファイルの姿の最終形も変わったものになっていくだろう。

このような中でも我々の自動運転技術の現状認識は次のようなものだ。

- 自動運転は、ディテクションの問題ではなく、AIコンピューティングの問題だということだ。(この部分は、モービルアイやBlue Boxを意識していると思われ。。。)

これはオブジェクトをディテクトするというものではなく、周囲の環境を知覚するという問題であり、周囲の環境の意味を理解するという問題であり、何をなすべきかの意味づけをするという問題なのだ。何が起こっていて、何をなすべきなのかは、この意味づけをもとに行われることになる。そしてこれは常に学習され続けなければならない。

AIコンピューティングは、多くの計算能力を必要とする。それが1ワットや2ワットでできるはずもなく、そんな省エネはすぐには起こらない。

(この部分はNXP Blue Boxとの比較を意識していると思われ。。。。)

そして人々は、自動運転のAIコンピュ―ティングは、ソフトウェアリッチな問題だと認識しつつある。そしてGPUとDLがそこで大きな役割を果たすことができるのだ。またそれは来年の2017年にも起こるであろうことで、もはや2021年の問題ではないのだ。

- 私たちはオープンな、単一のアーケティクチャプラットフォームを展開しようと考えていること。

自動車会社は、我々のプラットフォームの上で、ソフトウエアスタックを活用し、独自のAIニューラルネットワークを造ることができる。

それにより、高速道クルージングから完全自動運転まで、トラックからシャトルバスまで扱うことができることになる。

単一のコンピューティング・アーケティクチャを使うことにより、レーダーベースのシステムや、レーダー+カメラのシステムや、レーダー+カメラ+ライダーのシステムまで、センサーが融合した環境を幅広く構築できる。

我々のこの戦略は、自動車会社の方針と調和しており、関係者は5年前倒しでコンピュータ処理能力の増強が必要だと認識し始めている。

繰り返すが自動運転は、ディテクション問題ではなく、ソフトウェアインテンシヴなAIコンピューティング問題であり、このことがNVDAを有利なポジションに置いている。

ーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーーー

Q8:Mitch Steves - RBC Capital Markets LLC

新しいDRIVE PXがASPを増加させていくと思うが、その動向はどのようなものになるだろうか?私の記憶では自動車部門で、$30ミリオンの受注残があったと記憶しているが、その変化を教えてほしい。

A:Jen-Hsun Huang - NVIDIA Corp.

我々のDRIVE PXはスケーラブルだ。例えばParker SoC 1個から初めてサラウンドカメラを搭載することもできる。それだけで高速道でのAIクルージングも可能だろう。

さらに多くのカメラを搭載したい場合には、プロセッサを追加すれば、より多くの環境で機能を発揮することができるだろう。1チップから4チップまでのバリエーションがある。

そして完全自動運転や、ドライバーレスタクシーの場合には、4プロセッサでは足りないかもしれない。8プロセッサ、12プロセッサが必要かもしれない。

対応できないような環境を減らすべく自動運転を改良していく必要がある。車に運転手がいないも同然なのだから。つまり(必要とされるシステム構成は)どのようなアプリケーションを自動車企業が持っているかによって変わってくるのだ。

複数のチップ搭載パターンを持ち、それがスケーラブルなこと。数百ドル~数千ドルまでのパターンがあること。これにより、自動車会社が欲するあらゆるパターンに対応することができる。

これにより実装しやすく、コスト削減にもつながるシステム構成が可能となる。また数千ドルというのは、そのような事例では、無視してもいいぐらいのコストなのだ。

(質問に別の方法で答えてる気もするんだが。パーカーチップの価格帯がなんとなくわかった。妥当な値段付けで卸されているのはわかった。

11月以降発売のテスラの完全自動運転車は2,000ドルぐらいのDRIVE PX2買ってきて積んでるのか?システム自体のオプションが7,500ドルぐらいだったはずだから。)

―――――――――――――――――――――――――――――――――――――――

Q9:Harlan Sur - JPMorgan Securities LLC

クラウド市場での顧客だがAWS, the EC2 P2 platform, Microsoft Azureなどの名前が挙がってきている。彼らの新しいサービスでは、NVDAの(ケプラー世代ベースの)K80 アクセラレータープラットフォームが使われているところが面白いね。おそらくマクスウェル、パスカルは今後採用されていくだろうし、売上成長につながっていくだろうね。

この類のアクセラレーターは、なぜ長期のデザインサイクルが伴うものなのか教えてほしい。そして次世代のアーケティクチャが顧客に導入され始めるのはいつ頃のことだろうか。

A:Jen-Hsun Huang - NVIDIA Corp.

これこそが、5年前に大規模DC会社と協業を始めた理由なのだ。この間、いくつもの問題がクリアされなければらならなかった。

適切なアプリケーションが開発されなければならなかった。

DCレベルのアプリケーションが、新しいコンピューティング・プラットフォームに適応しなければならなかった。

ニューラルネットワークが開発されトレーニングされ、実用のための準備がなされなければならなかった。

GPUは、個々のDC向けにテストされなければならなかったし、個々のサーバーコンフィギュレーションに対してもテストされなければならなかった

。

巨大規模で実装するためには、一定の時間がどうしてもかかる。だからサイクルが長くなるのだ。

ただし Kepler、Maxwell、Pascalで我々のアーケティクチャが共通している点が重要だ。アーケティクチャのベースとなるものは劇的に改善しているのだが、そしてパフォーマンスも劇的に改善しているのだが、ソフトウェアのレイヤーは同一なままなのだ。

だから、将来世代の採用率は急速に進むであろうし、すぐにわかるだろう。( the adoption rate of our future generation is going be much, much faster and you'll see that.)

このように、我々のソフトウェア、アーケティクチャ、GPUを世界中のDCにインテグレートしていくのは時間がかかった。多くの努力と時間が必要だった。

―――――――――――――――――――――――――――――――――――――――

Q10:Romit J. Shah - Nomura Securities International, Inc.

オートパイロットに関してだが、なぜテスラはNVDAのシステムを選んだのか聞かせてほしい。立ち上げや時期( the ramp and timing)についても聞かせてほしい。このような新規提携がグロスマージンに与える影響を教えてほしい。

A:Jen-Hsun Huang - NVIDIA Corp.

- オートパイロットは、ディテクション問題ではなく、AIスーパーコンピューティング問題だ。これを最初に強調しておきたい(一台の車が、単独で周囲の状況を検知すればOKという問題ではないということ?熟練プログラマが職人技でアルゴリズムを組むのではなく、DLでトレーニングしたAIが勝手に学習していくということ?)。

NVDAのコンピュータ・アーケティクチャは首尾一貫している。プログラミングもできるし、ソフトウェアを書くこともできる。コンパイルもできる。NVDAのGPUコンピューティング・アーケティクチャは、10年にわたる改良の成果を持っている。今年が我々が最初にCUDA GPU(G80)を開発してから10周年だ。

- 次に、自動運転分野において、「常に改善しつづける車同士のネットワークサービス」これこそが、開発し市場に供給しなければならないものだと、自動車会社はすでに気づいている。

これは携帯電話産業や、ケーブルTVのセットトップボックスのようなものだ。メンテナンスされ、改良されつづけながら顧客にサービスされる必要がある。顧客はその企業の自動運転サービスに魅かれているのだから。

(Blue Boxを意識した発言だと思われ。。。NVDAとNXP+MBLY比べると、NVDAはプラットフォームインテンシヴで、後者はディテクションインテンシヴといえなくもないかも。路線バスとか長距離トラック向けでは圧倒的にNVDAのアプローチのほうが可能性がありそうだけれども、自家用車ではどちらになるかな?まだ誰も明確な答えを出せていない状況だろう。それにしてもゆくゆくは、トヨタがドコモみたいになってしまうということ?)

自動運転とは、ある特定の機能を開発すれば終わりというものではなく、よりよいマップ、よりよい自動運転走行、よりよい知覚能力、よりよいAIそのものだからだ。

自動車会社が我々のプラットフォームの上で開発した、各社独自のソフトウェア。これこそが、各社の強みとなるのだ。(だからグーグルのアプローチは可能性ないんじゃないかということ?少なくとも上位5社がグーグルのシステムをまんま採用するとは思えないよね。)

- 最後に、演算性能とエネルギー効率だ。自動運転に必要とされる機能とエネルギー効率を完全に両立させているプラットフォームが、すでに現時点で完成しているとは思わない。

DRIVE PX 2は、この惑星上で、この問題に対する現時点での唯一の妥当なソリューションだ。 テスラ・モーターズは、誰よりも5年先駆けてこの機能を実現するという強い意志を持っている。我々は彼らにとっても素晴らしいパートナーだ。

これらがテスラ・モーターズが我々を選んだ背景、理由だ。

―――――――――――――――――――――――――――――――――――――――

Q11:Matthew D. Ramsay - Canaccord Genuity, Inc.

グラフィックアクセラレータ企業から、AIコンピューティング・プラットフォーム企業への変身というのは素晴らしいアイデアだね。

AIとDLによる加速化が、ディファクトスタンダードとなったNVDAのプラットフォームの上で行われていくこと。このことをシリコンバレーのスタートアップ企業や、起業家たちが、NVDAのプラットフォームを使い、それを発展させつつ、相補的な関係を築いていること。これがNVDAの長期的な方向性とどのように関係してくるのか、現時点での見通しを聞かせてほしい。

A:Jen-Hsun Huang - NVIDIA Corp.

世界中で AI スタートアップ企業が生まれている。グローバルな出来事だといってよい。NVDAがトラッキングしているスタートアップ企業は1,500社程度だ。

そのためにInceptionプログラムがある。これを利用することにより、最新の技術、我々の専門知識、コンピューティング・プラットフォーム、DLについて我々が知りうるすべてを共有することができる。

これによりサイバーセキュリティから、ゲノム解析、コンシュ―マーアプリ、数理ファイナンス、IoT、ロボティクス、自動運転車などにDLを応用していくことができる。その数には驚くばかりだ。

PC一つでそれが利用できるのだ。$200だせば(クラウド上で)NVDAのGPUを利用しつつDLスタートアップを始めることもできるのだ。

これをHP, Dell, Cisco, IBM, 大規模システム開発会社、小規模システム開発会社、地域密着型のシステム開発会社などから利用できる。サービスは、クラウドDC上から展開されており、世界中から利用できるのだ。

AWS, Azureなどは、すばらしいスケールアウト性を実装してくれている。IBMクラウド、Alibabaクラウドなども同様だ。

コンピューティングのために時間当たり数ドルの予算があれば、スタートアップを始めることができ、どこにいてもNVDAのプラットフォームを利用することができる。これは驚くべき生産性を持ったプラットフォームだ。

世界中のあらゆるDLフレームワークを、どこにいても動かすことができる。これによりAIスタートアップ企業に、大きな市場化の可能性を与えることができるのだ。

―――――――――――――――――――――――――――――――――――――――

Q12:David M. Wong - Wells Fargo Securities LLC

ゲーミング売上で60%成長は素晴らしいね。これは既存のチャンネルで達成された売上なのか、新しい販売チャンネルができてそれもあって達成されたのか?(任天堂スイッチ向け売り上げが含まれているのかを聞いているのだろう。)

A:Jen-Hsun Huang - NVIDIA Corp.

販売チャンネルにほとんど変化はない。長い間既存のチャンネルを活用している。それはすでに大規模なネットワークになっているからだ。

GeForce プラットフォームを世界中に届けることができるパートナー企業と、良好な関係を築いてきたことがNVDAの強みの一つだ。これにより地球上のどこにいても我々の製品にアクセスすることが可能だ。

任天堂もこの成長に貢献してくれた。彼らとは2年にわたり協力してきた。任天堂はアーケティクチャ―へ長期にわたって関与してくれるので、期待している。

(これはゲーム業界全体のproduction valuの増大に任天堂が長年貢献してきたのか、Q3の売上に任天堂向けチップの売上が含まれているのか判断しがたい答え方であった。おそらくは前者であり、任天堂をヨイショしているものと思われる。だってまだフル生産には早すぎね?どちらにしろ任天堂向けのチップは、無視していいわけではないが、NVDAの年間業績を左右するほどのインパクトはないと思われ。)

―――――――――――――――――――――――――――――――――――――――

最後に:Jen-Hsun Huang - NVIDIA Corp.

我々は、すべてのプラットフォームで成長を目の当たりにしている。

チップ企業からコンピューティング・プラットフォーム企業への転換には手ごたえを感じている。

GameWorks、GFE、DriveWorks、(またすべてのAIを、グラフィック仮想化プラットフォームすなわち) GRID から NVIDIA GPU DLツールキットなどの上で走らせることができること。

これらを見ていただければ、この転換を感じていただけることだろう。

これほどの多くの分野にわたる市場を扱っていることは、我々の経験上初めてのことだ。たとえばAI、自動運転、ゲーミング、VRなどなどなど。

またGPUによるDLが世界中にAIイノヴェーションをもたらしているのは周知の事実だ。

我々の過去7年間にわたる戦略とは、end-to-endな AIコンピューティング・プラットフォームを作り上げることだった。そのためにDLにたいし、あらゆる事業領域を最適化し、発展させてきた。

またNVIDIA DLI(Deep Learning Institute)を通じて、彼らが開発しているソフトウェアを革新するためのDLの使い方を人々に伝えてきた。

以上です。

October 2016 steam hardware survey

毎月恒例のスチームサーベイでグラボの売れ行きをチェックします。

DX12対応GPUの中での採用率の推移

Aug Sep Oct

GTX 1060 0.30% → 0.90% → 1.41% (+51 basis points)

GTX 1070 0.98% → 1.42% → 1.77% (+35 basis points)

GTX 1080 0.68% → 0.88% → 1.03% (+15 basis points)

マクスウェル世代GPU

Oct

GTX 980 Ti 1.33% ( +0.02%)

GTX 980 1.33% ( -0.04%)

GTX 970 7.08% ( -0.05%)

GTX 960 5.24% ( -0.04%)

順調にマクスウェル世代からパスカル世代へのアップグレードが進んでいることがわかりますね。とりわけGTX1080の採用ペースの速さに驚かされます。VR、4Kゲーミングが実用レベルになるということで、リッチなアメリカ人みんな買っているんでしょうかね。オラも1080もう一個買ってSLIにしようかな。

Q4には 1050 および 1050Ti の売上も含まれてきますので、やはりゲーミングの売上UPはQ4でもというか、Q4でこそ期待できます。

さらに注目すべきは、マクスウェル世代のベーシスポイントの低下幅を上回る、パスカル世代の採用率の上昇があるという点です。

これは高性能グラボ市場全体の規模が拡大していることを示していると思います。このことはジェンスンがカンファレンスコールで、熱く語っていたことと整合性がありますね。

ホリデーシーズンを控えてこのモメンタムが突然変化するとは考えにくいです。現時点ではQ4決算も期待できるといっていいでしょう。毎月グラボの売れ行きをウォッチして行きたいと思います。

以下参考資料

〇DX12対応 PC割合 71.91%

〇ビデオカードトータルシェア

〇DX12GPU 採用率ランキング

提灯行列のお通りだーい!アップグレードなど

●Goldman Sachs : Toshiya Hari

target $92 → $129

status Conviction Buy

Nvidia's "unique growth story," positioning among gaming, VR/AR and automotive trends, data center business growth potential and expectations for estimate revisions to mark positive catalyst in upcoming quarters.

→ ゴールドマンのコンヴィクションバイは、売りサインとして有名

●Mizuho : Vijay Rakesh

target $80 → $115

status buy

●Evercore : CJ Muse

target $120

status Hold → Buy

data center revenue will continue growing at an approximately 50% compound annual growth rate (CAGR).

●Needham & Company: Rajvindra Gill

target $100

status Hold → Buy

今期レヴェニュー予想 $6.04ビリオン → $6.837ビリオン

今期 EPS 予想 $2.27 → $2.93

来期レヴェニュー予想 $6.34B → $7.834B

来期EPS予想 $2.20 → $3.10

● RBC Capital Markets:Mitch Steves

target $80 → $95

status Outperform

●Jefferies: Mark Lipacis

target $80 → $95 → $110

status Buy

forecasts $5 of EPS power in 3 years.

→今後3年で $150 狙えるってこと?

● Barclays : Blayne Curtis

target $54 → $72

status Underweight → Equal weight

Q4 レヴェニュー予想 $2.06B-$2.14B (ガイダンス $2.10B、既存コンセンサス $1.69B).

※「今年ずーっと間違いまくっててゴメンナサイ、だけどGPUはDLの推理・推論用にはホントは向いてないんだけど、まだその有望代替技術が育ってきてなくて、NVDAがリーダポジションにいるだけだよ。」との負け惜しみコメントつき。株価は当然$72の遥か上。

そして、しゃあしゃあと既存のコンセンサスや会社のド級ガイダンスを上回る、Q4レヴェニュー予想を提示(だけど幅をもたせて、下限がガイダンスを下回るところに悪あがきを感じるね)

ポックンは、会社側のガイダンスはこれでもも保守的にしてると思うナリ。

●Pacific Crest Securities:Michael McConnell

target $80

status Sector Weight

Q4レヴェニュー予想 $1.76B

グロスマージン予想 58.1% (vs. company-issued 59.2%)

Q4 EPS予想 $0.80 (vs. consensus $0.57).

※業績好調なのは認めますが静観しますとのコメントつき

※なんかターゲット株価とレヴェニューとEPSがちぐはぐな予想だな。ちゃんと計算してんのか?

・MKM Partners : Ian Ing

target $87 → $106

status Buy

2025年までにAI市場は、半導体関連だけでも$15ビリオン市場に成長するとのこと

・データセンターでの機械学習向け ($2B-$4B)

・自動運転向け ($9B+ per 10% unit share increment)

・DL ($4B) [drones, robots, niche verticals etc.]

合計で $15B+ figure.

Citi : Atif Malik

data center sales in 2017 and 2018 driven by artificial intelligence and considers the segment as the company's quickest growing end market.